In the world of DeFi there are many concepts without which the ecosystem could not function and progress. There are oracles, which provide data and prices present outside the Blockchain, there are Governance tokens, for the management of protocols in a decentralized way and there are the so-called Wrapped Tokens.

Wrapped Tokens are a way to connect tokens and/or coins from different blockchains in a simple and effective way. The most intuitive example concerning this particular type of tokens are WBTCs: Wrapped BTCs follow the ERC20 standard and allow Bitcoin to be used within Ethereum’s DeFi increasing interoperability and liquidity between networks.

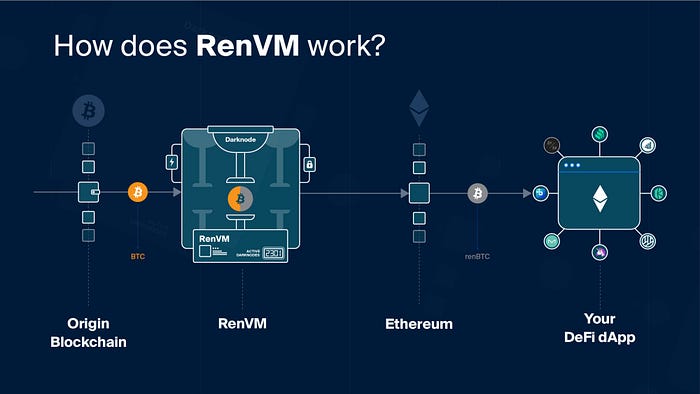

How? By depositing the BTC to be converted into a custodian account they will be blocked and a token will be issued with 1:1 collateralization compared to the amount deposited. The custodian can be a centralized entity, see Wrapped Bitcoin subject to KYC/AML controls, or Smart Contracts as on RenProtocol, which uses RenVM as a decentralized, trustless and permissionless entity to issue renBTC.

The use cases of Wrapped tokens are very interesting because they allow you to earn a return within DeFi platforms while continuing to have exposure to the price of the underlying asset. WBTCs currently have a capitalization of 15 billion, demonstrating how high the interest is in using Bitcoin in the Ethereum ecosystem.

Fun fact: Another curious example of Wrapped Tokens are WETHs. Wrapped Ethereum tokens are “special” tokens because they wrap Ether with the ERC20 standard. In fact, since ETH was created before the ERC20 standard emerged, the need arose to “wrap” even the base coin of the network in order to use it in DeFi.